So, you've heard about Dow Jones futures, but what exactly are they? Let's dive into the nitty-gritty of this financial concept that's shaping global markets. Whether you're a seasoned investor or just starting out, understanding Dow Jones futures is crucial. It's like having a crystal ball that gives you a glimpse into the future of the stock market. So buckle up, because we're about to break it all down for you.

Dow Jones futures have become a buzzword in the financial world, but not everyone knows what they entail. Imagine being able to predict how the market will behave before it even opens. Sounds pretty cool, right? Well, that's what Dow Jones futures are all about. They're essentially contracts that allow investors to speculate on the future value of the Dow Jones Industrial Average (DJIA).

Now, you might be wondering why these futures matter. Well, they provide valuable insights into market sentiment and can help investors make informed decisions. Think of them as a barometer for the overall health of the economy. So, whether you're trying to hedge against risk or looking for new investment opportunities, understanding Dow Jones futures is a must-have skill in today's fast-paced financial landscape.

What Are Dow Jones Futures?

Alright, let's get down to business. Dow Jones futures are financial contracts that represent an agreement to buy or sell the Dow Jones Industrial Average at a predetermined price and date in the future. These contracts are traded on exchanges like the Chicago Mercantile Exchange (CME) and are used by traders and investors to speculate on the direction of the market.

One of the key features of Dow Jones futures is their ability to provide liquidity and flexibility. Unlike traditional stock trading, futures allow you to trade outside of regular market hours. This means you can react to breaking news or global events in real-time, giving you a competitive edge in the market.

Why Are Dow Jones Futures Important?

Here's the deal: Dow Jones futures offer a snapshot of how investors feel about the market before it even opens. They're like the weather forecast for the stock market. If futures are trading higher, it could indicate optimism and potential gains. On the flip side, if they're trading lower, it might signal caution or even fear among investors.

- They provide early signals for market trends

- Help investors manage risk through hedging

- Offer opportunities for profit through speculation

- Enable trading during pre-market and after-hours sessions

How Do Dow Jones Futures Work?

Let's break it down. When you trade Dow Jones futures, you're essentially betting on whether the DJIA will rise or fall. For example, if you think the market will go up, you can buy a futures contract. Conversely, if you believe it will drop, you can sell a contract. The beauty of futures is that you don't need to own the underlying asset to participate in the market.

Here's a quick rundown of how it works:

- Choose a futures contract based on the DJIA

- Decide whether to buy or sell the contract

- Settle the contract at expiration or close your position earlier

Understanding the Mechanics

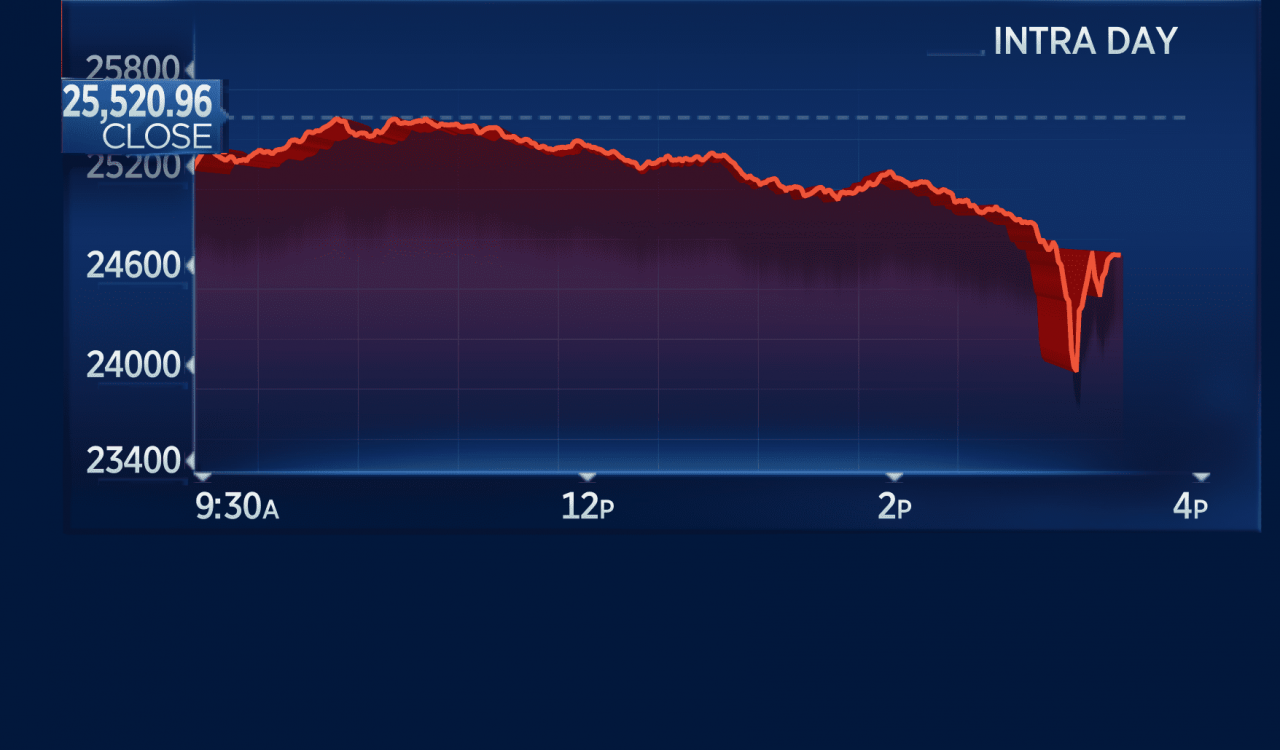

Now, let's talk about the nitty-gritty details. Each Dow Jones futures contract represents a specific value of the DJIA. For instance, one contract might be worth $25 per point. So, if the DJIA moves by 100 points, your profit or loss would be $2,500 per contract. It's a high-stakes game, but with great risk comes great reward.

The History of Dow Jones Futures

Let's rewind a bit. Dow Jones futures were introduced in 1997 by the Chicago Board of Trade (CBOT), which later merged with the CME. The goal was to provide a more efficient way for investors to trade the DJIA. Over the years, these futures have become a staple in the financial world, with traders and institutions relying on them for market insights.

Interestingly, the introduction of Dow Jones futures coincided with a period of rapid globalization and technological advancements. As markets became more interconnected, the need for real-time trading tools grew. Dow Jones futures filled that gap, offering traders a way to stay ahead of the curve.

Evolution Over Time

Fast forward to today, and Dow Jones futures have evolved into a sophisticated financial instrument. Advances in technology have made trading more accessible, while increased market volatility has highlighted their importance. Whether you're a retail investor or a hedge fund manager, these futures play a crucial role in your investment strategy.

Key Players in the Dow Jones Futures Market

So, who's involved in this game? The Dow Jones futures market attracts a diverse range of participants, including:

- Hedge funds

- Institutional investors

- Individual traders

- Market makers

Each group has its own goals and strategies. Hedge funds, for instance, often use futures to hedge against risk in their portfolios. Meanwhile, individual traders might focus on short-term gains through speculative trading. Regardless of their motivations, all players contribute to the liquidity and efficiency of the market.

Role of Market Makers

Market makers are the unsung heroes of the Dow Jones futures world. They provide liquidity by continuously buying and selling contracts, ensuring that there's always a buyer or seller available. This helps maintain price stability and allows traders to execute their orders smoothly.

Factors Affecting Dow Jones Futures

Like any financial instrument, Dow Jones futures are influenced by a variety of factors. Here are some of the key drivers:

- Economic indicators (e.g., GDP, unemployment rates)

- Global events (e.g., political instability, natural disasters)

- Corporate earnings reports

- Federal Reserve policies

For example, if the Federal Reserve announces a rate hike, it could lead to a sell-off in the market, causing Dow Jones futures to decline. On the other hand, strong corporate earnings might boost investor confidence and push futures higher.

News and Sentiment

News plays a critical role in shaping the direction of Dow Jones futures. In today's 24/7 news cycle, even a single tweet from a world leader can send shockwaves through the market. That's why staying informed and keeping an eye on global developments is essential for anyone trading futures.

Advantages of Trading Dow Jones Futures

So, why should you consider trading Dow Jones futures? Here are some compelling reasons:

- Leverage: You can control a large position with a relatively small amount of capital

- Liquidity: The market is highly liquid, allowing for easy entry and exit

- Flexibility: Trade during pre-market and after-hours sessions

- Hedging: Protect your portfolio from market volatility

While there are risks involved, the potential rewards make Dow Jones futures an attractive option for many investors.

Risks to Consider

Of course, no investment is without risks. Some of the key risks associated with Dow Jones futures include:

- Market volatility

- Leverage-related losses

- Counterparty risk

It's important to have a solid risk management strategy in place before diving into the world of futures trading.

How to Get Started with Dow Jones Futures

Ready to jump in? Here's a step-by-step guide to getting started with Dow Jones futures:

- Choose a reputable broker that offers futures trading

- Open a margin account and fund it with the required amount

- Learn the basics of futures trading and risk management

- Start small and gradually increase your position size

Remember, education is key. The more you know, the better equipped you'll be to navigate the complexities of the market.

Choosing the Right Broker

Not all brokers are created equal. When selecting a broker, consider factors like:

- Trading platform features

- Commissions and fees

- Customer support

- Regulatory compliance

A good broker can make all the difference in your trading journey.

Conclusion

Well, there you have it—a comprehensive guide to Dow Jones futures. From their definition to their role in the market, we've covered everything you need to know to get started. Remember, while Dow Jones futures offer exciting opportunities, they also come with risks. So, do your research, stay informed, and always have a plan.

Now, it's your turn. Share your thoughts in the comments below or check out our other articles for more insights into the world of finance. Happy trading!

Table of Contents

- What Are Dow Jones Futures?

- Why Are Dow Jones Futures Important?

- How Do Dow Jones Futures Work?

- Understanding the Mechanics

- The History of Dow Jones Futures

- Evolution Over Time

- Key Players in the Dow Jones Futures Market

- Role of Market Makers

- Factors Affecting Dow Jones Futures

- News and Sentiment

- Advantages of Trading Dow Jones Futures

- Risks to Consider

- How to Get Started with Dow Jones Futures

- Choosing the Right Broker